Introduction

Disruption isn’t just a buzzword—it’s the heartbeat of the modern tech world. Every decade has its wave of startups that completely rewrite the rules. The 1990s gave us Amazon and Google, the 2000s brought us Facebook and Tesla, and the 2010s saw the rise of Zoom and Stripe. Today, in 2025, we’re standing on the brink of another massive transformation, powered by artificial intelligence startups, climate tech startups, and emerging technology companies working at lightning speed.

This year, investors, founders, and even governments are keeping a close eye on the most innovative startups that might become the next trillion-dollar giants. Venture capital startups are attracting record-breaking funding, unicorn startups 2025 are popping up faster than ever, and startup company ideas that once sounded like science fiction are turning into reality.

So, which startups are worth watching? We’ve done the digging for you and curated the top 5 most disruptive tech startups of 2025. These companies aren’t just riding trends—they’re building the future.

The rise of disruptive startups in 2025

Startups have always been engines of change. But what makes 2025 different is the convergence of multiple technologies: AI, blockchain, biotech, and green tech are feeding into each other, amplifying innovation like never before.

Why disruption is happening now:

- Artificial Intelligence startups are scaling generative AI into business operations, not just consumer apps.

- Climate tech startups are benefiting from government incentives and global urgency to hit net-zero emissions.

- Top fintech startups 2025 are challenging banks with lightning-fast digital solutions.

- Top health tech startups are using AI, wearables, and predictive analytics to reshape healthcare delivery.

- Venture capital startups are backed by billions in tech startup funding, fueling rapid unicorn growth.

The pace is so fast that what seems “innovative” today may be mainstream in just 18 months. That’s why knowing the startups to watch 2025 is crucial for investors, students, and anyone interested in technology’s future.

1. NeuroLogic AI – redefining artificial intelligence

Why AI is ripe for disruption

The AI sector has exploded in the last five years. While companies like OpenAI and Anthropic dominate headlines, a new wave of artificial intelligence startups is emerging with specialized innovations. The demand is clear: businesses want faster, cheaper, and more scalable AI solutions that integrate seamlessly with real-world workflows.

Meet NeuroLogic AI

Among the new AI companies, NeuroLogic AI stands out. The company builds neural processing chips designed exclusively for AI workloads. Unlike traditional GPUs that juggle gaming, graphics, and computation, NeuroLogic’s hardware is purpose-built for AI training and inference.

What makes it disruptive:

- Custom hardware: 3x faster training for large AI models.

- Energy efficiency: Uses 40% less power than GPUs.

- Enterprise traction: Partnerships with Fortune 500 firms in finance and logistics.

- Rapid growth: Valued at $1.5B, officially joining unicorn startups 2025.

Potential impact:

- Healthcare: Faster medical imaging diagnostics.

- Finance: Better fraud detection and risk modeling.

- Climate science: Simulating carbon emissions and environmental changes.

Challenges to watch:

- Competition from giants like NVIDIA.

- Scalability of chip production.

2. GreenCore Energy – climate tech with impact

Why climate tech is booming

Climate change isn’t a future problem—it’s here. Governments worldwide are rolling out strict carbon targets, and businesses are desperate for affordable solutions. This urgency has turned climate tech startups into some of the most attractive emerging technology companies for investors.

Meet GreenCore Energy

GreenCore Energy is disrupting the space with modular carbon-capture devices. Unlike bulky, expensive systems, GreenCore’s units are plug-and-play and affordable enough for both big factories and small businesses.

What makes it disruptive:

- Cost efficiency: 70% cheaper than traditional systems.

- Flexibility: Works in factories, farms, and urban areas.

- Funding: Secured $500M in tech startup funding.

Real-world impact:

- Factories: Reduce heavy industry emissions.

- Cities: Deployable in urban centers for cleaner air.

- Small enterprises: Affordable solutions to meet compliance laws.

Challenges to watch:

- Scaling production to meet global demand.

- Policy hurdles in different regions.

GreenCore Energy is proof that the most innovative startups don’t just make profits—they make the planet livable.

3. MediSync Health – the future of digital healthcare

Why health tech is transforming

Healthcare systems worldwide are struggling with rising costs, aging populations, and doctor shortages. Enter top health tech startups, which use AI, wearables, and telemedicine to provide proactive, predictive care.

Meet MediSync Health

MediSync Health uses AI-driven predictive analytics to anticipate patient needs before they escalate. By integrating hospital data with wearables, it offers real-time health monitoring.

What makes it disruptive:

- AI-first care: Predictive models prevent hospital readmissions.

- Telemedicine 2.0: Doctors use AI assistants to speed consultations.

- Unicorn status: Valued at $2.3B, joining unicorn startups 2025.

Benefits across the board:

- Patients: Early diagnosis and affordable care.

- Doctors: Reduced workload with AI support.

- Systems: Lower healthcare costs.

Challenges to watch:

- Privacy of sensitive medical data.

- Integration with legacy hospital systems.

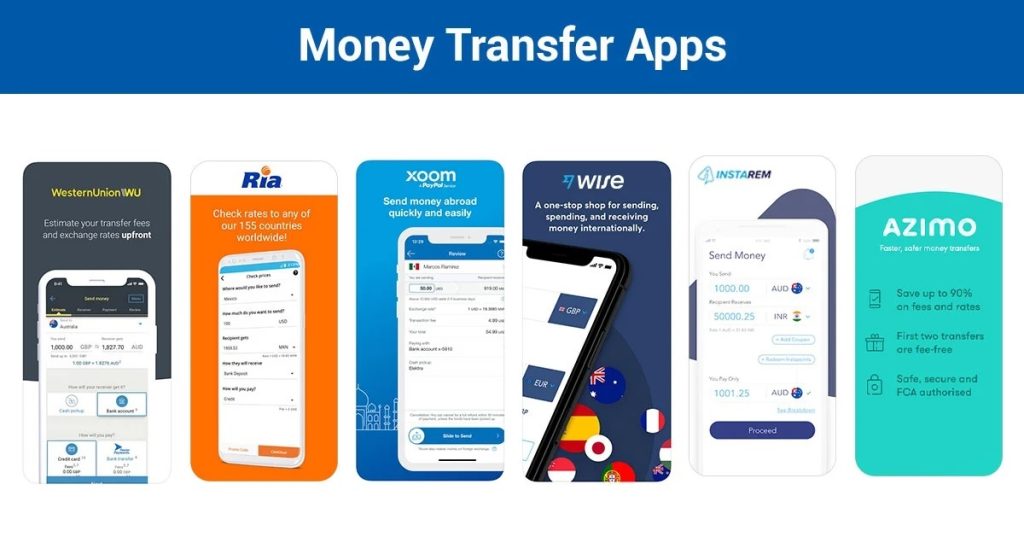

4. FinX Global – fintech at its finest

Why fintech is still hot

Financial services are ripe for disruption. Traditional banks move slowly, charge high fees, and are often inaccessible to the unbanked. That’s why top fintech startups 2025 are exploding—they’re faster, cheaper, and more user-friendly.

Meet FinX Global

FinX Global is reimagining cross-border payments. Its blockchain and AI-driven platform processes transactions in seconds instead of days.

What makes it disruptive:

- Speed: Instant money transfers.

- AI compliance: Automated fraud detection and anti-money laundering.

- Financial inclusion: Expanding banking access to underserved communities.

Impact:

- Migrant workers save billions in remittance fees.

- Small businesses simplify global trade payments.

- DeFi enthusiasts integrate blockchain finance with traditional services.

Challenges to watch:

- Regulatory hurdles across borders.

- Security risks tied to blockchain adoption.

5. BioForge Labs – biotech meets AI

Why biotech is the future

Traditional drug development takes 10–15 years and billions in R&D costs. With global health crises looming, this model is unsustainable. Enter biotech startups that leverage AI for faster breakthroughs.

Meet BioForge Labs

BioForge Labs uses AI to accelerate drug discovery, cutting development time from years to months.

What makes it disruptive:

- AI-driven discovery: Identifies promising drug compounds quickly.

- Market potential: Pharma giants are already lining up for partnerships.

- Funding: Raised $750M in its last venture capital startup round.

Applications:

- Rare diseases: Making treatments financially viable.

- Personalized medicine: Tailoring drugs to individual genetics.

- Pandemic readiness: Predicting future viral mutations.

Challenges to watch:

- Regulatory approval timelines.

- Ethical debates on AI in biotech.

Runner-up startups to watch

Beyond the big five, here are other startups to watch 2025:

- EcoTrack Systems – A climate startup building real-time carbon tracking software for corporations.

- QuantumEdge – An emerging technology company working on quantum computing for logistics and security.

- HealthMate AI – A new AI company making personalized fitness and diet apps smarter with predictive coaching.

- PayLink Pro – A fintech startup providing AI-powered lending for small businesses.

- SolarNova – A climate tech firm creating next-gen solar roof tiles for homeowners.

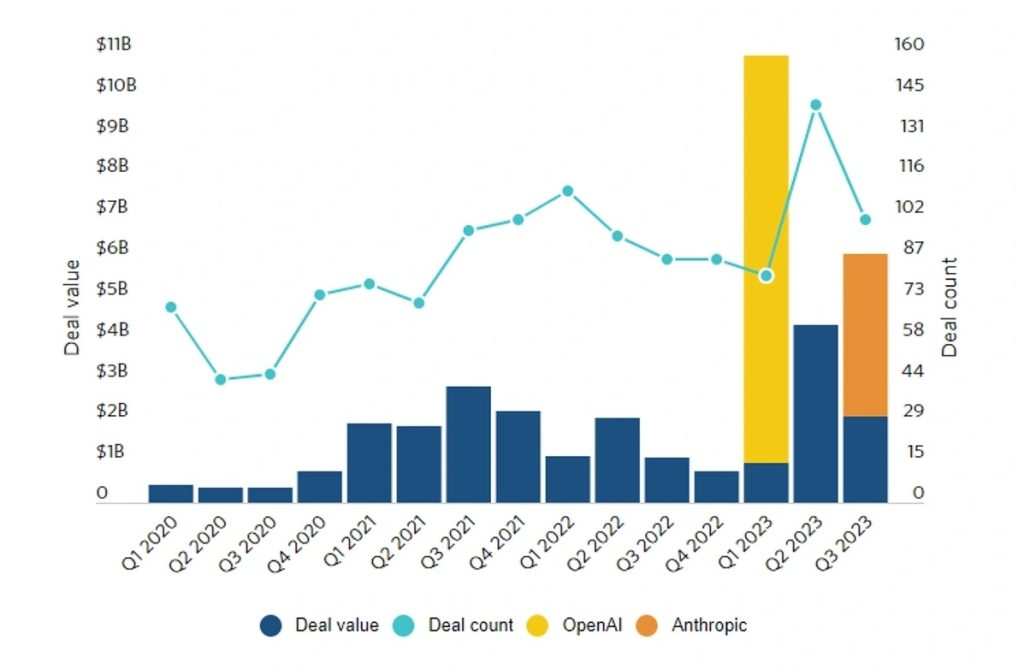

The role of funding: Venture capital and unicorn growth

The role of funding: Venture capital and unicorn growth

Disruptive startups need massive capital to scale. 2025 is breaking records:

- AI dominates with billion-dollar funding rounds.

- Climate tech startups get boosted by policy incentives.

- Fintech draws consistent investment.

- Health tech stays strong due to ongoing demand.

In short: funding drives disruption. Without capital, even the best startup company ideas can’t scale into unicorn startups 2025.

Future outlook: Where disruptive startups are headed

Looking to 2030, expect these trends:

- AI everywhere: From farming to space exploration.

- Climate urgency: Green startups will become mandatory, not optional.

- Healthcare reimagined: Predictive health will replace reactive medicine.

- Fintech dominance: Digital-first banks may overtake legacy ones.

- Biotech leaps: Personalized medicine will be as normal as annual checkups.

These emerging technology companies are just the start—the real disruption is still coming.

Final thoughts

The top 5 most disruptive tech startups of 2025—NeuroLogic AI, GreenCore Energy, MediSync Health, FinX Global, and BioForge Labs—are shaping the future. From artificial intelligence startups to climate tech startups and top fintech startups 2025, these companies are proving that disruption is no longer optional—it’s inevitable.

Whether you’re an investor chasing the next unicorn, a student brainstorming startup company ideas, or just a tech enthusiast, keeping an eye on these startups to watch 2025 ensures you’ll stay ahead of the curve.

FAQs

1. What are the most innovative startups in 2025?

The most innovative startups include NeuroLogic AI (AI hardware), GreenCore Energy (climate tech), MediSync Health (healthcare AI), FinX Global (fintech), and BioForge Labs (biotech). These companies combine cutting-edge tech with real-world impact, setting them apart from traditional players.

2. Why are artificial intelligence startups attracting so much funding?

AI startups are versatile—they can power healthcare, finance, logistics, education, and consumer products. Because of this cross-industry utility, new AI companies are magnets for investors, consistently raising some of the largest funding rounds in 2025.

3. Are climate tech startups profitable or just impactful?

Climate tech startups are both. With stricter emissions regulations and government incentives, businesses see climate tech as a compliance tool and a cost saver. That’s why climate tech startups are attracting billions in revenue, not just goodwill.

4. What makes a startup a unicorn in 2025?

A unicorn startup 2025 is a private company valued over $1B. To get there, a startup typically needs disruptive technology, rapid adoption, and significant venture capital funding. Many unicorns this year reached billion-dollar valuations in under five years.

5. Which sectors will see the next wave of disruptive startups?

Beyond AI, climate, fintech, and biotech, we’ll likely see growth in space tech, food tech, and quantum computing. The next emerging technology companies may be solving problems we don’t even know we’ll face yet.

6. How can individuals invest in these startups?

Most venture capital startups are closed to retail investors. However, you can participate through angel investing platforms, equity crowdfunding, or by buying IPO shares when these companies go public. For long-term investors, tracking unicorn IPOs is often the most practical route.

7. What are trending startup company ideas for 2025?

Some of the hottest startup company ideas include AI-powered education platforms, eco-friendly consumer tech, decentralized finance apps, and wearable health devices. These ideas match rising consumer demand with technological feasibility.